Where to learn trading forex

Interested in learning online forex trading but not sure where to start? We've curated a list of four articles that will provide you with valuable information and tips to kickstart your journey into the world of forex trading. From understanding the basics to mastering advanced strategies, these articles cover a wide range of topics to help you become a successful forex trader.

The Ultimate Beginner's Guide to Forex Trading

Forex trading, also known as foreign exchange trading, is a lucrative and exciting market that attracts thousands of traders from around the world, including India. For beginners looking to dip their toes into this fast-paced world, having a comprehensive guide is essential.

"The Ultimate Beginner's Guide to Forex Trading" is a must-have resource for anyone looking to start their journey in the forex market. This guide covers all the basics of forex trading, from understanding the terminology to learning how to analyze the market and make informed trading decisions.

One of the key benefits of this guide is its user-friendly approach. Even the most complex concepts are broken down into easy-to-understand language, making it accessible for beginners with no prior experience in trading. Additionally, the guide provides practical tips and strategies that can help new traders navigate the market with confidence.

For anyone in India who is interested in starting their forex trading journey, "The Ultimate Beginner's Guide to Forex Trading" is an indispensable resource. Whether you are looking to supplement your income or pursue trading as a full-time career, this guide will provide you with the knowledge and tools you need to succeed in the forex market.

Top 5 Forex Trading Strategies for Success

Forex trading can be a lucrative venture for those who have the right strategies in place. In the fast-paced world of Forex, it is essential to have a clear plan and stick to it in order to achieve success. Here are some top strategies that can help traders in India navigate the volatile market and increase their chances of success.

One of the most important strategies for Forex trading success is having a solid understanding of the market. This includes knowing how different factors such as economic indicators, geopolitical events, and market sentiment can impact currency prices. By staying informed and keeping up-to-date with market news, traders can make more informed decisions.

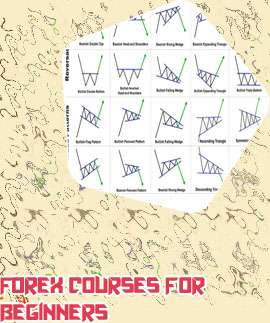

Another key strategy is to use technical analysis to identify trends and patterns in the market. By analyzing charts and using indicators such as moving averages and Fibonacci retracements, traders can better predict price movements and make profitable trades.

Risk management is also crucial in Forex trading. By setting stop-loss orders and limiting the amount of capital risked on each trade, traders can protect their investments and minimize losses.

Additionally, having a trading plan and sticking to it is essential for success in Forex trading. By setting clear goals, identifying entry and exit points, and following a disciplined approach, traders can avoid emotional decision-making and stay on track towards their objectives.

Common Mistakes to Avoid in Online Forex Trading

In the fast-paced world of online Forex trading, it's easy to get caught up in the excitement and make some common mistakes that can cost you dearly. One of the most common errors that traders in India tend to make is overleveraging. This happens when traders borrow more money than they can afford to lose in the hopes of making a quick profit. While leveraging can amplify gains, it can also magnify losses, leading to financial ruin.

Another mistake that traders often make is not having a solid trading plan. Without a clear strategy in place, it's easy to get swayed by emotions and make impulsive decisions that can lead to losses. It's important to set clear goals, define your risk tolerance, and stick to your plan no matter what.

Furthermore, many traders fail to do proper research before making trades. It's crucial to stay informed about market trends, economic indicators, and geopolitical events that can affect currency prices. Without proper research, you're essentially trading blind, which can lead to disastrous results.

Avoiding these common mistakes is crucial for success in online Forex trading in India. By being mindful of overleveraging, having a solid trading plan, and conducting thorough research, you can increase your chances of making profitable trades and minimizing risks. Remember, Forex trading

How to Choose the Best Forex Trading Platform

When it comes to trading in the Forex market, choosing the right trading platform is essential for success. With so many options available, it can be overwhelming to decide which platform is best suited for your needs. In India, where the Forex market is rapidly growing in popularity, selecting the right platform is crucial for traders to effectively navigate the market.

One key factor to consider when choosing a Forex trading platform is regulation. It is important to ensure that the platform you choose is regulated by a reputable regulatory body, such as the Securities and Exchange Board of India (SEBI). This provides traders with a level of security and protection, as regulated platforms are required to adhere to strict guidelines and standards.

Another important consideration is the features and tools offered by the trading platform. Look for a platform that offers a user-friendly interface, advanced charting tools, real-time data feeds, and a variety of order types. These features can help traders make informed decisions and execute trades more efficiently.

Additionally, it is important to consider the fees associated with using the platform. Some platforms may charge commission fees, spreads, or other hidden costs that can eat into your profits. Look for a platform that offers competitive pricing and transparent fee structures.

List of Forex Forex Trading in Tamilnadu

- The top 10 forex brokers

- Rbi approved forex trading app

- Forex brokers with low minimum deposit

- Forex trading profit per day

- Top 10 forex brokers in the world

- Application forex trading

- What is bitcoin and forex trading

- Forex for you login

- Forex broker ranking

- Sebi registered forex brokers

- Top forex brokers list

- Forex trading indian broker

- Top rated forex broker

- Forex trading time in india

- Forex broker spreads

- Best forex cashback brokers

- Top forex brokers

- Best spread forex broker

- Best forex broker low commission

- International forex brokers

- Forex spot trading broker

- How to start forex trading india

- Top trading platforms for forex

- Forex brokers with no deposit bonus 2024

- Best paypal forex broker

- India forex broker

- Multi currency forex card

- Biggest forex broker

- Best forex broker with mt4

- Best forex brokers in india

- Forex broker crypto

- Forex trading indian broker

- Forex trading

- Top forex broker in hindi

- Where to learn forex trading

- What is forex

- Forex broker regulations

- Forex broker welcome bonus no deposit

- Lowest spread forex broker

- What is a forex broker

- Top 10 forex brokers in india

- Top 50 forex brokers in the world

- Forex factory news

- Best forex brokers

- When did forex trading start

- Forex trading in india

- Forex market open hours

- Fintechzoom best forex broker

- Forex broker ratings

- How can i learn forex trading

- Forex

- Become an indian forex broker

- Forex trading meaning

- Best forex broker